New Money: The Rise of Wealthtechs in Africa

Wealthtechs are opening up global wealth building opportunities for Africans.

A five-year-old African fintech startup is now worth more than some of the continent’s biggest banks. Flutterwave's mission to link Africa to the global economy by making local and international payments seamless has made it the second African fintech payment company to ascend into unicorn status. After Interswitch who did it after 17 years in operation.

Now, more fintechs like Chippercash, TeamApt, Paga, and Opay are already either unicorns or would be valued at $1b really soon. Add the Paystack acquisition to this mix, and there's evidence that African startups can also play the grand online game. It is also why the continent is seen by some as the next frontier for global capital.

Just with about everything, the internet has changed the way we use money. Most financial services - like payments and lending - have been digitized and disrupted to an extent. But for the wealth management industry, its digitization and disruption are just on the way.

Today, anyone with a smartphone can make trades and invest in almost any asset class in the world. Aroung 19 million of the 7 billion people on the planet are High Net Worth Individuals (HNIWs). These are people with at least $1 million in liquid or investable assets.

Around 7 million High Net Worth Individuals come from North America. Over 6 million are Asians, and approximately 5 million are from Europe. In Africa, there are about 145,000 HNWIs. These African HNWIs hold about 42% of the continent's $2.2 trillion wealth.

A significant percentage of African HNWIs reportedly prefer investing in real estate. Especially in foreign cities like London and Dubai. Africans are supposedly the largest buyers of prime property in central London. These are the type of clients that traditional wealth managers (professionals who manage personal wealth for individuals) typically target. But this narrative is changing.

Over one-quarter of HNWIs investments are in real estate and alternative assets.

Wealth management isn't only valuable for HNWIs or seasoned investors seeking to preserve and grow their wealth in the long term. In our pandemic-induced, and crypto-tokenized world, both the middle and working classes are coming to grips with the wealth management game. This is driven by a subgroup of fintechs called Wealthtechs - financial technology companies at the intersection of technology and wealth management.

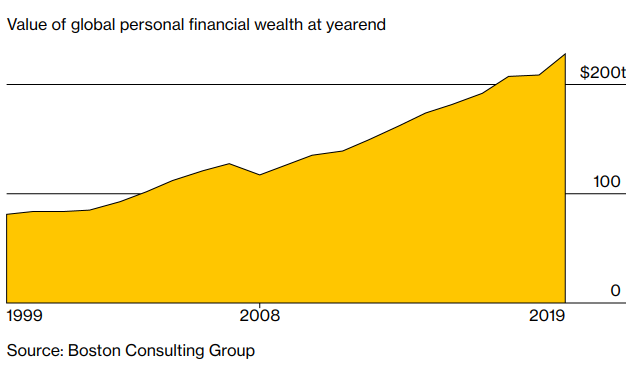

Since the financial crisis in 2008, the world has become more prosperous as personal financial wealth has doubled since the crisis. We now have a world growing in wealth, looking to manage its riches more efficiently.

By Bloomberg

Wealthtechs Rising

Fintechs rose from the ashes of the 2008 global financial crisis and have since been driven by the worldwide adoption of high-speed internet, alongside smartphone and mobile technology saturation.

They’re in the spotlight because they tend to provide more convenience by digitizing a critical niche financial service at a fraction of the cost that traditional financial institutions can manage.

Globally, fintechs have found success in digitizing financial segments like payments, lending and even insurance. However, the wealth management industry has been slow with the times. Despite taking a while to embrace the power of digital fully, the industry is now catching up and is one of the hottest fintech subsectors at the moment.

Wealthtechs, which essentially provide a digital layer on top of wealth management processes and services, offer local & global investment opportunities to a new class of investors - novice retail investors. These are individual or non-professional investors that are mainly made up of smartphone-wielding millennial and Gen-Z customers.

Wealthtechs have enabled the rise of retail investors by democratizing access to global financial markets, speculative assets like crypto-DeFi and NFTs. Alternative investments such as PE/VC (private equity/venture capital), hedge funds, and real estate. Typically, most of these assets were only available to sophisticated investors/HNWIs.

Wealthtechs can pull a power shift in the wealth management industry because of a broader customer base (retail investors) and shifting customer needs and expectations. They remove a lot of complexity for retail investors by using technology to lower customer acquisition costs and decentralize investing. Now, a lot of conventional wealth managers have no choice but to play catch up.

Then there’s the increasing VC appetite for Wealthtech that shows that the industry is on the up. Global WealthTech funding more than doubled in Q2 2020 quarter over quarter, reaching close to $1.2 billion in Q2 2020, up from $450 million in Q1 2020.

The African Wealthtech Context

The reality for many Africans is that a lot of asset classes like bonds, stocks, real estate, to talk more of alternative assets, were not readily available to them. Until now.

Traditionally, they would have to go through physical middlemen (brokers), and getting access to these assets required paying hefty fees and commissions.

A lot of Africans do not consider investing in assets across their local markets. Mainly because of the limited knowledge around investing, the inflation and currency devaluations in several countries, and the imperfect local asset markets in the continent.

Over the last 4-5 years or so, the number of investing options available to Africans soared significantly. Two factors have driven this trend:

The democratisation of existing assets by wealthtechs.

The emergence of new assets like Crypto and NFTs.

Wealthtechs are providing a spectrum of solutions that include:

Digital brokerages: These are online trading platforms or stock trading apps that democratise trading to a potential or underserved user base by simplifying the investing process through models like fractional investing and social trading. Fractional investing is when you’re able to buy a fraction of a stock or asset. Social trading is the embedding of social networks in the investing arena. Investors can discuss opinions with other peer traders and replicate the investment strategies of both their peers and “expert” traders.

Robo-advisors: Platforms that use machine-learning algorithms to determine the model investment portfolios for customers based on their financial goals and risk preferences.

Micro-investment platforms: Here, people can save or invest in small amounts without worrying about high minimum deposit and threshold requirements.

Portfolio Optimization: These solutions provide cost-effective solutions for more efficient portfolio management.

Investment tools: are geared towards research, monitoring portfolio - by creating notification alerts for setting goals and managing investment portfolios.

Blockchain & Crypto: Blockchain & Cryptocurrencies are creating new financial experiences for millions of people and will still go on to create new types of asset classes. Then there is Decentralized finance (DeFi), whose primary goal is to cut out the middlemen from all kinds of financial transactions. DeFi is now replicating many of the financial systems and companies that exist, including lending, options and insurance. The Defi industry market cap has grown ~5000% from $1.8 billion to ~$92billion in the last year.

The US investment market dictates to the rest of the world as they are 400% larger than the next market. The most popular Wealthtech, Robinhood, started in 2013. Traditional brokerages charged $7 - $10 per trade, while Robinhood charged less. Then in 2015, Robinhood launched an app that leveraged great UX and gamification. Now you can trade on Robinhood for free (or not). It has now pushed its commission fees down to zero. Today Robinhood’s valuation is $12b (one of Silicon Valley’s most valuable unicorns), with a $30b IPO planned in the coming months.

In China, the prominent wealthtechs are Futu and Yu’e Bao by Alipay. Futu is a traditional Chinese Brokerage that went digital. It lets its users invest in overseas's equities. The company has a $25b valuation. While Alipay is the biggest money market fund globally with 600 million investors. So half of China’s population is invested in a money market fund.

Another interesting Wealthtech is Zerodha, India's most prominent retail stock brokerage. They started offering no-commission trades in 2015. Now, they account for 15% of all retail trading in India. They've never raised money and are a unicorn without any debt.

In Africa, most Wealthtechs are online savings and investment platforms (micro-investing and digital brokerages). Other players include crypto companies as well as asset/fund managers.

In West Africa, specifically Nigeria. The wealthtechs you'll find are:

Digital brokerages/Stock trading apps like Chaka, Bamboo, Trove and Passfolio.

Investing marketplaces like Wealth.ng

A fund manager (automated dollar investing platform) like Risevest

High-interest saving accounts and micro-investing wealthtechs like Piggyvest & Cowrywise.

Crypto saving and investment apps like Bitnob.

PE/VC democratisation platforms like GetEquity

In East Africa, especially Kenya, a country that has achieved near-total financial inclusion at 82.9% of its population, wealthtechs aren't as spread as they are in Nigeria.

In Kenya, the prominent Wealthtech is Abacus, which charges users a subscription for financial data and allows Kenyans to invest/trade while charging a percentage commission of order purchases. Other players are saving platforms like Chumz, and assets trading platforms like Scope Markets.

In South Africa, Etoro is the biggest Wealthtech. The company uses a model that is a mash-up of commission fee trading and social trading network (copy trading). There is also AvaTrade similar to Etoro as well Easy equities. Then there is Revix, that allow people invest in crypto and gold or a bundle of the top 10 crypto-currencies ( a sort of mini index fund).

In North Africa, there's WealthFace that offers global investment opportunities to willing investors in the MENA region. There's also Thndr, an Egyptian Robinhood clone that allows people to invest in local and foreign stock markets without paying commissions. Instead, Thndr offers a monthly subscription model that unpacks deep market data, research and technical analysis to its users.

The Next Wealthtech Wave

Wealthtechs are not just democratizing and increasing access to money management services for retail investors. They are also helping to increase financial literacy levels in a world where about 30% of women and 35% of men globally were classified as financially literate in 2015.

As more wealthtechs pop up to make investing much more accessible, they will also inadvertently help to improve the financial literacy levels in the world.

The growing awareness and usage of wealthtechs have opened up the wealth management universe to new retail customers that are driven by value for money. The increasing availability of investment product information is making investors savvier as they move towards innovative digital solutions that provide customised portfolio allocations and simplify sophisticated features.

These digital solutions are impacting the entire value chain of wealth management through technology like big data, blockchain, artificial intelligence, and APIs. This is, in turn, fueling a decline in the industry’s commission fees.

Despite all these, current Wealthtechs are still only scratching the surface of what’s possible. They’ve only managed to digitize existing wealth management services by eroding the barrier to entry, opening the wealth management scene to a mass of new retail investors.

While these incumbent wealthtechs tend to place their focus on user experience and marketing in their bid for more traction. They have yet to promote true technological differentiation and innovation in regards to architecture/infrastructure, asset management, data analysis, security and personalisation in the wealth management sector.

The next generation of wealthtech should bring more innovation. Wealthtechs won't just rely on the democratization of wealth management services to masses like their predecessors. They will offer genuine digital personal financial advice and automated portfolio profiling to users instead of just access to different types of assets.

They will create a tailored portfolio for each user by leveraging behavioural finance, artificial intelligence, big data, APIs and 5G to sharpen their profiling algorithms to assess a user's risk profile and financial goals more accurately.

The turning point for the sector will be opening asset management methods like quantitative management (use of computers and mathematical techniques to sift through financial statistics to select assets) to retail investors.

Incumbent wealthtechs are digitizing the asset allocation process. In the future, they will digitize the investment decision-making process, but there is still some work to do before we get there.

New Money Flows in Africa

Technology is slowly but surely changing the face of Africa. More portions of the population are accessing the web using mobile devices, which is paving the way for fintech to thrive. So it is unsurprising that the continent has caught the WealthTech bug.

But unlike other Fintech segments like payment and lending in Africa, wealth management is still not mass-market, but this is slowly changing.

As consumer expectations of financial services in Africa continue to evolve with the proliferation of fintechs, the wealth management industry is now opening up to Africans. And, wealthtechs in Africa are at the centre of this game. Providing access to local and international investment opportunities in a continent rife with economic hardship.

They're placing more focus on saving and investing, unlike their other fintech counterparts, who put more emphasis on spending and consumption.

Wealthtech is enabling the shift from savings accounts to more local and foreign asset classes for people in the black continent. They are eliminating the drawbacks and challenges these people have with managing their money. With many fake scams targeting Africans with promising rich returns, having transparent platforms that help them easily save and invest is a breath of fresh air.

Meanwhile, one big hurdle to the growing wealth-management industry in Africa might be the regulatory environment. But crypto seems like a viable stop-gap solution to this problem.

As Africa breeds a new generation of wealth owners and wealth seekers, African wealthtechs will need to evolve as we enter a time where crypto and DeFi will have more sway.

While there is a lot of market share on the table to fight for, Wealthtechs in Africa must focus on growing the market. They need to help potential local investors increase their financial knowledge and develop their financial responsibility as well as enter new markets.

Africa is experiencing new money flows other than the regular remittances from “the abroad”. Young Africans in Lagos, Kigali, Accra & Johannesburg are building wealth by sidestepping their problematic local markets. Instead, they’re investing in foreign stock exchanges and new asset classes from Africa using just their smartphones and a bunch of wealth management apps.

As technology continues to make the world smaller, turning every digitally-savvy human into a global citizen, you can expect Africa to print new money dollar millionaires and billionaires.

It is an exciting time for young Africans, and I can’t wait to see where this takes us.

Thanks for reading! I’d love to hear your reactions and ideas. You can do this by commenting on this post or come say hello on twitter.