Flutterwave's Flywheel

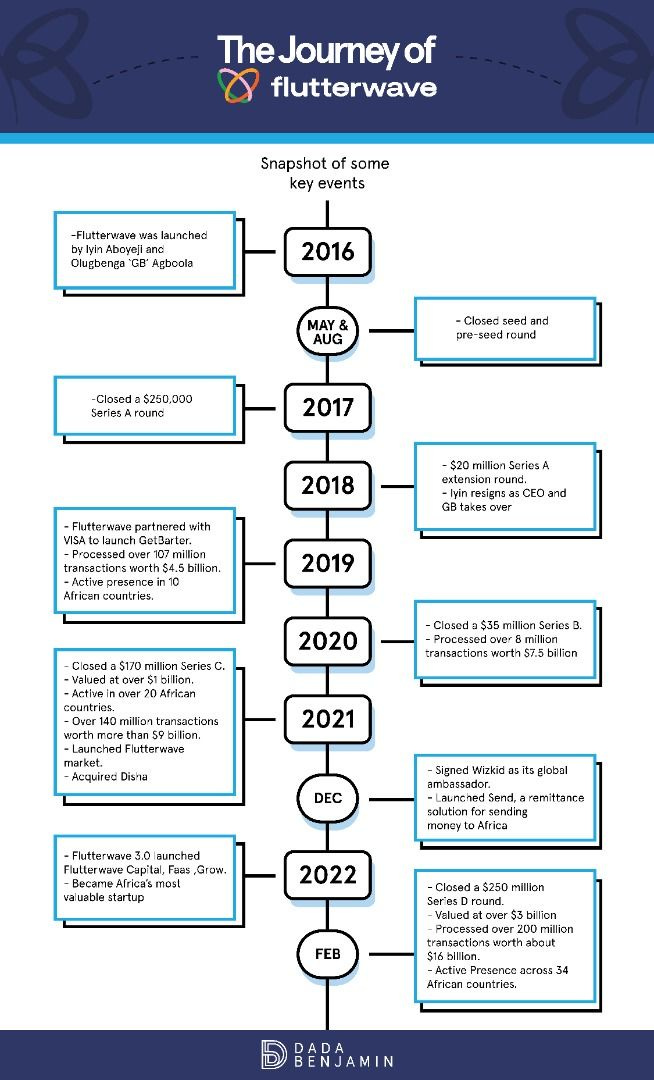

A glance at how Flutterwave built advantages on its way to being valued at $3 Billion in 6 years.

There’s no doubt that David Hundeyin's piece on Flutterwave brought to light the corporate shortcomings of the company, and despite the seemingly weak attempt to quell this corporate gloomy cloud hanging over the unicorn startup, it is evident that this is a startup that has failed at some things but has also done great at some of the other things that matter. And shows that Flutterwave still has a lot to learn in its bid to seamlessly connect Africa to the world's global economy.

But this post isn't about Flutterwave's scandal but a look at its business system. The thing that makes it tick at its core.

On a long, mild, grey night in Seattle during the dot.com bust in 2001, Jeff Bezos, sketched on a napkin the company's concept of a virtuous cycle focused on the customer.

This cycle called the — Amazon's flywheel, became something of an enigma in the business world.

Now flywheels are an important part of Amazon's culture and individual teams in the company are encouraged to use flywheels in their processes.

Flywheels are nothing new. They’ve been around for a long time. But it wasn’t till Jim Collins developed the concept of a business flywheel in his book Good to Great that it started to gain attention.

Meanwhile, it was Jim who coached Bezos and the Amazon executive team about Flywheels.

In 1957, Walt Disney drew one of the first comprehensive examples of a flywheel. He called it the Synergy Map.

The Synergy Map was a visual representation of how each of the different components of Disney's business and brand would coexist and complement one another and how the company's IP (its studio) would influence and drive every other facet of the business.

That Disney's Flywheel became a blueprint for the colossal brand Disney is today. Disney’s Flywheel shows how its different business systems, distribution channels, potential markets and the sourcing of new ideas, could all come together to provide more value and entertainment for its customers while growing the company's brand and product potential, meanwhile increasing revenue and creating new opportunities.

While flywheels can seem like a static image, they certainly are not. Rather, they're dynamic, continuously moving, evolving and self-sustaining.

In physics, flywheels are mechanical devices remarkable at storing and releasing energy, so once they are in motion, they are difficult to slow down.

In business, flywheels are all about building advantages that enable sustainable growth, where an almost manic focus on turning the right levers feeds growth.

Flutterwave, a startup that set out to solve payment challenges in Africa and change how the world does business with the continent is currently Africa's most valuable startup, with a valuation of $3 billion, all after 6 years. All the while building a flywheel that has fueled this growth.

What does Flutterwave do Exactly?

Flutterwave is a payment technology company that offers banks, businesses and individuals in Africa seamless and secure payment experiences.

Flutterwave's started out as a payment platform for accepting online payments and has gone on to broaden its product suite beyond payments.

Its product offerings are:

Flutterwave Checkout (Rave): For Collecting payments online or in-store from customers around the world in over 30 currencies.

Barter by Flutterwave: a mobile app for sending and receiving money instantly.

Send by Flutterwave: a remittance product for making instant money transfers from various countries around the world using different payment options to mobile money wallets, bank accounts, and cash pick-up locations in Africa.

Flutterwave Commerce: a suite of e-commerce tools for selling online under the umbrella — These tools include the Flutterwave store, Payment links and Flutterwave Invoicing.

Flutterwave's Card issuing: a service that lets large corporate entities, small businesses, and individuals create and manage their own virtual and physical cards.

Flutterwave FaaS (Fintech -as-a-Service): a solution which helps businesses become Fintech companies by embedding financial services into their products using Flutterwave’s APIs.

Flutterwave Capital: a lending service for merchants and businesses who are Flutterwave's users to borrow up to $20,000 to grow their business.

Flutterwave Grow: a B2B product that simplifies the process of registering and incorporating a business in the US, UK, and Nigeria from anywhere by removing all the complexity of paperwork and legal procedures.

Disha: a platform for creatives and makers acquired by Flutterwave.

Flutterwave's payments network isn't only accessible via mobile and web channels, but also via USSD, and Point of Sale (POS) channels as well.

Flutterwave founders claim that the company tapped into the butterfly effect (chaos theory) in its founding days. A contrast to the usual game theory many startups leverage.

The Butterfly Effect is the idea that a small, unpredictable variable such as a butterfly flapping its wings, could impact a complex system and set off a major event such as a tornado in Texas.

Flutterwave's rise to unicorn status did not happen by chance. It has become one of the most innovative companies in Africa in parts by building a Flywheel.

Here's an illustration of Flutterwave's journey to its $3 billion valuation:

Immediately after its last $250m series D funding round, Flutterwave launched Flutterwave 3.0, a revelation of where the company is at currently, and where it might be headed.

In its first year of operations, Flutterwave processed over 10 million transactions worth $1.2 billion in payments partnering with 10 Bank Partners across Africa. By the end of 2018, Flutterwave had processed $2.6 billion in transaction value.

By 2019 the company had doubled its transaction value to $4.5 billion, and by 2021 its transaction value had doubled again to $9 billion.

Can it maintain the same trajectory in 2022 and beyond? Well, only time will tell.

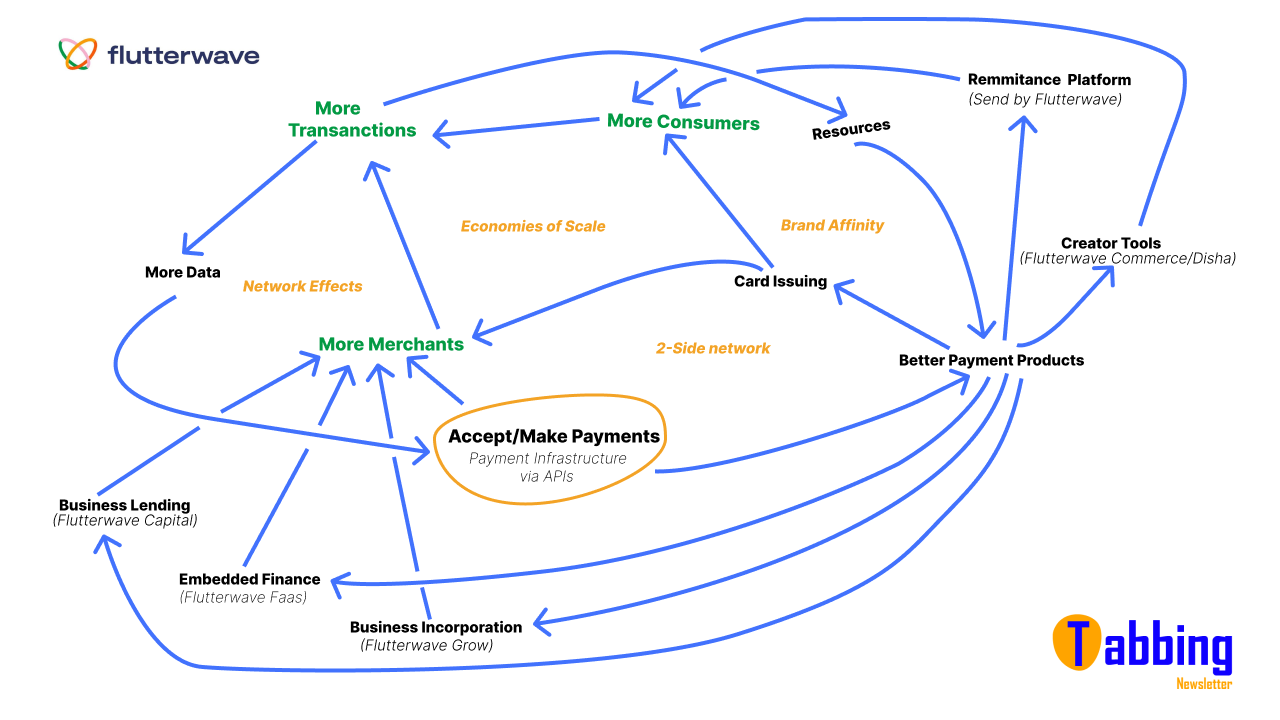

Flutterwave's Flywheel

A business flywheel is a very useful tool for understanding a company or its systems. It shows how A increases, how it leads to more of B, which in turn increases C. As C increases it flows back to A and the cycle begins anew.

Like compounding interest, investments in one area of the business flows through to other areas of the business. Setting off a series of accumulating advantages that the company enjoys over time.

There are 6 common examples of accumulating advantages represented as flywheels or “causal loops” (in Systems thinking), and they can be expressed uniquely depending on the context.

Understanding a company's flywheel can help identify where the wheel is spinning smoothly, and where a little bit of grease might come in handy.

For a long time, before the continent's current fintech craze. Payments were a big barrier to African trade. And Flutterwave was launched in a bid to remove this barrier for merchants.

For example, at first, the company built a payment acceptance product called Rave for large corporate clients and registered businesses, however, they quickly learnt that a lot of their merchants were "one-man businesses" (creatives, freelancers, and consultants).

Flutterwave quickly had to update Rave to work for them as well.

Currently, the company's payments infrastructure technology is accessible via its public and Open APIs, enabling anyone in Africa to launch and support businesses that can scale. And Flutterwave isn’t just setting its sights on Africa alone, the company sees itself as a global payment company that will inevitably play in other developing markets outside Africa.

Flutterwave was willing to play in a heavily fragmented digital payments ecosystem and solve some of the most fundamental payment problems that merchants, businesses and even financial institutions in Africa were facing. By building a strong backbone for the back-end of payments.

Flutterwave streamlined the complicated process of accepting online payments by solving hurdles like regulations, fees, compliance standards, fraud risk and payment card issuers — which were more complex for international transactions.

As Asemota posited in this tweet thread above, the back-end of payments was a mess and Flutterwave went about solving it by developing strong back office support for it.

And this is how the Flutterwave flywheel began to take shape.

Now let's examine the Flutterwave flywheel a bit more closely.

Network Effects

Popular VC firm a16z defines Network effects as: "when a product becomes more valuable to its users as more people use it".

From this definition, you can argue that Flutterwave has network effects because it has been able to attract more customers (merchants & consumers) by helping them make more sales with its checkout tech, its commerce and creator tools, and make payments with its card-issuing service and payment app. Which has led to significantly more volume transactions on the platform.

Its strong payment infrastructure has enabled it to offer embedded finance to businesses, a business growth service, and a credit facility product for businesses on the platform.

Flutterwave's network effects offer the startup a strategic position in the payments space in Africa.

Economies of Scale

Flutterwave's economies of scale are evident with its transnational value doubling almost every year since it began operations. As the density of Flutterwave's network increases, so does the number of payments that goes through the platform

Flutterwave's pricing has also been top of the market, which has contributed to its economies of scale.

2-Sided Network Effect

Merchant payment markets are naturally 2-sided. Where payers and payees have different needs, incentives and reasons for using a particular product. Flutterwave has been able to scale both sides of the market in a way that generates sufficient momentum and critical mass among merchants as well as individual consumers.

Proprietary Tech

When it comes to the digital payment landscape in Africa, Flutterwave’s higher-tech performance (proprietary tech) has brought about an arguably better payment product you can find anywhere in the African market.

Which has in turn brought in more customers and has increased the company's experience in building and improving its product suite.

Brand Affinity

Flutterwave is very much associated with its brand value proposition: Easier digital payments for Africans.

Flutterwave's network effects and economies of scale have led to more merchants and consumers using the company's platform. Flutterwave's network will continue to grow as it expands into other African countries, which will lead to more brand affinity for the company and also bring about lower acquisition costs for customers.

However, there’s uncertainty about how its latest corporate scandal has affected its brand.

Switching Costs

Despite Flutterwave's other flywheel advantages, the company hasn't been able to replicate a switching costs advantage.

African customers have become adept at switching products as the market isn’t built in a way where one company has enough moat to wholly hold on to customers and avoid them switching to alternatives. This is very evident in the telco industry as well as the banking industry.

Looking Forward to Flutterwave’s Future

Over the past few years, Flutterwave has focused on developer support, continental expansion, product innovation and increasing strategic partnerships.

Partnerships have become an important lever for Flutterwave. It has partnered with a host of global companies that include Visa, Chinese e-commerce giant - Alibaba, and WorldPay. As well as top local companies like MTN.

Fundamentally, Flutterwave’s product and strategic initiatives fall under 3 main goals:

Connect Africa seamlessly to global commerce.

Support merchant partner growth and promote internet-focused entrepreneurship.

Encourage growth in industries outside Payments. e,g sports, entertainment and education.

The company’s future is to create endless possibilities for every business. Not exactly an easy feat.

Flutterwave has continuously innovated on its product offering, expanding into new business lines and customer segments, enabling the company to cross-sell additional products to customers.

What’s next for Flutterwave will most likely involve growth in partnerships, acquisitions, product innovation and investments.

Flutterwave has filled a critical gap in the digital payments ecosystem in Africa. It is widening online commerce and making digital payments useful to the everyday consumer. Meanwhile, Flutterwave is intent on remaining indispensable to merchants in its network as it offers new business products.

However, Fluttwave has not been successful at steering clear of cultural and corporate issues that plague many global Unicorns and how that affects its brand going forward is yet to be truly seen.

As Flutterwave ramps up its transaction volume from both existing customers and new customers from new markets, it seems the Flutterwave flywheel is still building steam and yet to take off. Which signifies the opportunities ahead for new revenue streams across a broader range of products.

Have a great week,

- Fosi